Everyone wants a piece of Silicon Valley. Few can get it. If you’re just a new venture investor arriving in Silicon Valley, it’s a long climb to the top. It’s even steeper if you’re an institutional investors from overseas.

None of that stopped Chinese magnate Shan Xiangshuang from creating the largest seed fund in Silicon Valley in just three years. The billionaire chairman of private-equity firm CSC Group set up Hone Capital in 2015, backed by $115 million and an unusual mandate for such a large fund: invest in hundreds of quality early-stage startups as fast as possible.

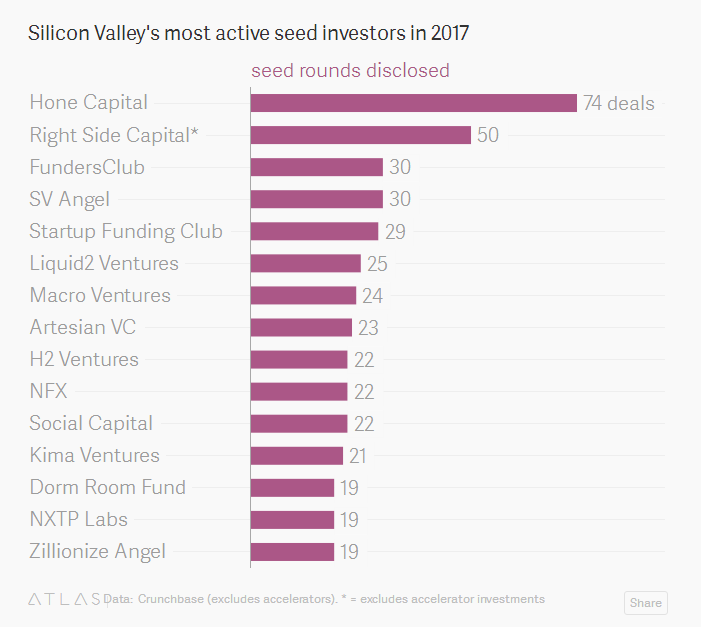

Since then, it has quickly, and quietly, placed more than $40 million in at least 350 companies. In the past year, alone, Hone (formerly CSC Venture Capital) backed at least 74 companies by writing checks ranging from $23,000 to $250,000. That pace puts it ahead of every other seed investor except for accelerators such as 500 Startups, Y Combinator and SOSV, according to data provided by Crunchbase (although not all seed deals are publicly disclosed).

“Very quietly, we’ve become the most active investor in the Valley,” says Hone’s managing partner Veronica Wu, who used to lead Tesla Motors’ operations in China and Apple’s Chinese enterprise business.

None of it would have been possible a few years ago

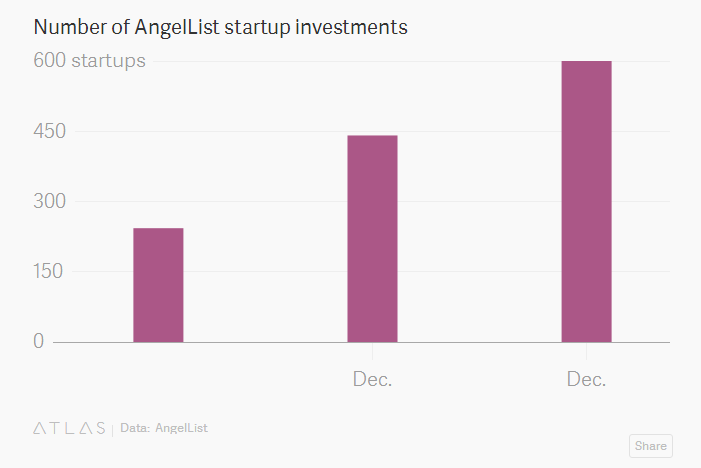

With the internet finally invading the clubby, offline world of venture capital, the startup investment and network site AngelList has served as the barbarian at the gates. The platform’s goal is to enable thousands of angel investors to place money in multiple startups without screening them one by one. It has turned highly skilled operators into prolific investors by giving them legal, administrative and operational support, as well as an efficient way to pool investors and close deals. Today, AngelList has closed well over 1,800 investments worth $685 million. It runs 60 Angel Funds as well as more than 150 active “syndicates“—venture-capital funds that make a single investment by joining with multiple institutional investors or sophisticated angels.

That’s proven to be the secret to Hone’s success.

It was virtually impossible for large institutional funds to deploy hundreds of millions directly into quality, early-stage startups. The best deals in Silicon Valley are closely guarded. Investors can spend years cultivating talented founders to ensure they’re on the inside track when they launch their next venture. For those in the Bay Area, out-of-town cash is often dismissed as “dumb money”: investors lacking the connections or expertise that ostensibly comes with established names.”It’s very hard to crack into the Silicon Valley ecosystem,” Wu says. “You get scraps.”

It was virtually impossible for large institutional funds to deploy hundreds of millions directly into quality, early-stage startups. The best deals in Silicon Valley are closely guarded. Investors can spend years cultivating talented founders to ensure they’re on the inside track when they launch their next venture. For those in the Bay Area, out-of-town cash is often dismissed as “dumb money”: investors lacking the connections or expertise that ostensibly comes with established names.”It’s very hard to crack into the Silicon Valley ecosystem,” Wu says. “You get scraps.”

To compete, new investors in the US and overseas seek any opening they can find. Many race to invest in early-stage startups at demo days or through access to accelerator pipelines (Y Combinator’s model). Some investors, such as Fidelity and hedge funds, have opted to place multi-million bets on late-stage startups such as Uber. Others have set up shop in the Bay Area with more established firms, beginning the long, difficult process of establishing a name.

The due diligence required to vet hundreds individual companies is formidable. Early-stage deals are done after laborious meetings with data still flowing primarily through spreadsheets. “The VC model hasn’t really changed, ever,” Dave Lambert, managing director of Right Side Capital, tells Quartz. (Right Side created custom software to streamline the process.) “It’s a 100% labor-driven process on the investor side.”

So most still place their money in “funds of funds” to distribute among premier venture firms with the ability to screen, vet and invest in a handful of companies every year with fees and profit-sharing adding up to as much as 30% of the original investment.

Investing the Hone way

Hone Capital “hacked” that model, Wu says. AngelList gave Hone unfettered access to all private syndicated deals in the system, and partnered with AngelList as the platform’s largest outside investors. Hone makes some direct investments, but most money flows through hundreds of syndicate leads and Angel Funds on the platform. Hone picks from these deals syndicated on AngelList. It has pre-approved some funds for fast-moving deals such as those that come on demo days. The firm also has the flexibility to invest directly into promising startups, or introduce them to existing syndicates. Hone designed its own algorithms to quickly analyze companies, sectors and investor track records (tracking 17,000 investors over the past 10 years), and relies heavily on the judgment of syndicate leads.

Hone has made more investments in the last two years than many funds do over their entire history. The fund says 50% of its seed-stage deals have led to follow-on investments (far above the industry average), and Hone estimates its returns put it among the top 20% of investors.

Even with early success, it’s not clear the model will scale, as Silicon Valley likes to say. Hone’s three-year track record will only be fully reckoned with once startups in its portfolio go public or are acquired—a prospect that could take 10 years or more.